New innovation and growth in decentralized exchange

Dex volumes are inflecting

Dexes are here!

It took a little longer than anticipated, but decentralized exchanges are finally seeing accelerating growth in volumes and serving certain assets more effectively and globally than centralized exchanges. Technological maturity, the proliferation of tokens, and a bullish outlook on the market are helping to drive volumes.

The dex space saw $2.4 billion of volume in 2019. But in 2020, we’re estimating approximately $7.1 billion in annualized volume, a 194% year-on-year increase.

CoinFund’s Devin Walsh identifies some of the drivers of dex volume.

Protocol tokens are driving growth

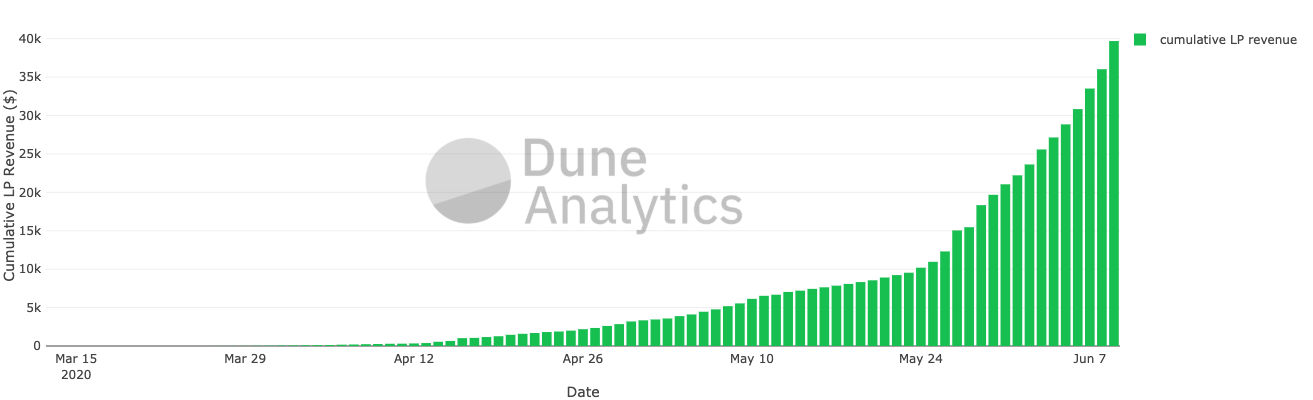

Protocol tokens are playing a key role in the growth of dexes and other open finance protocols. After Balancer Labs introduced the $BAL token as part of their governance roadmap and liquidity mining program, active network participation shot up dramatically across key metrics like revenue and number of liquidity pools. The number of liquidity providers on Balancer saw a 10-fold increase.

Dexes competing with centralized exchanges

New technologies are increasingly enabling dexes to compete with centralized exchanges. AMMs like curve.fi, have been able to give traders better exchange rates for stablecoin trades than traditional order book markets like Coinbase. The following analysis we ran at CoinFund shows that Curve consistently outperforms Coinbase exchange rates, after fees, in the DAI-USDC market by 33.6 basis points.

Loopring is one of the first zk-rollup based exchanges, using the technology to create a user experience indistinguishable from a centralized exchange but fully non-custodial. There will be much more innovation in this space, but Loopring has been one of the first such dexes to hit market and its token, $LRC, has returned over 300% year to date.

Jake Brukhman is the founder and CEO at CoinFund, a blockchain technology investment firm based in New York City. This content is presented for informational purposes and should not be construed as legal or financial advice or as a solicitation to invest in any opportunity.