All digital content is going on-chain

CoinFund's NFT thesis and our investment in Rarible

Read this article on Medium. Read Rarible’s announcement.

NFTs are intellectual property rights to digital content

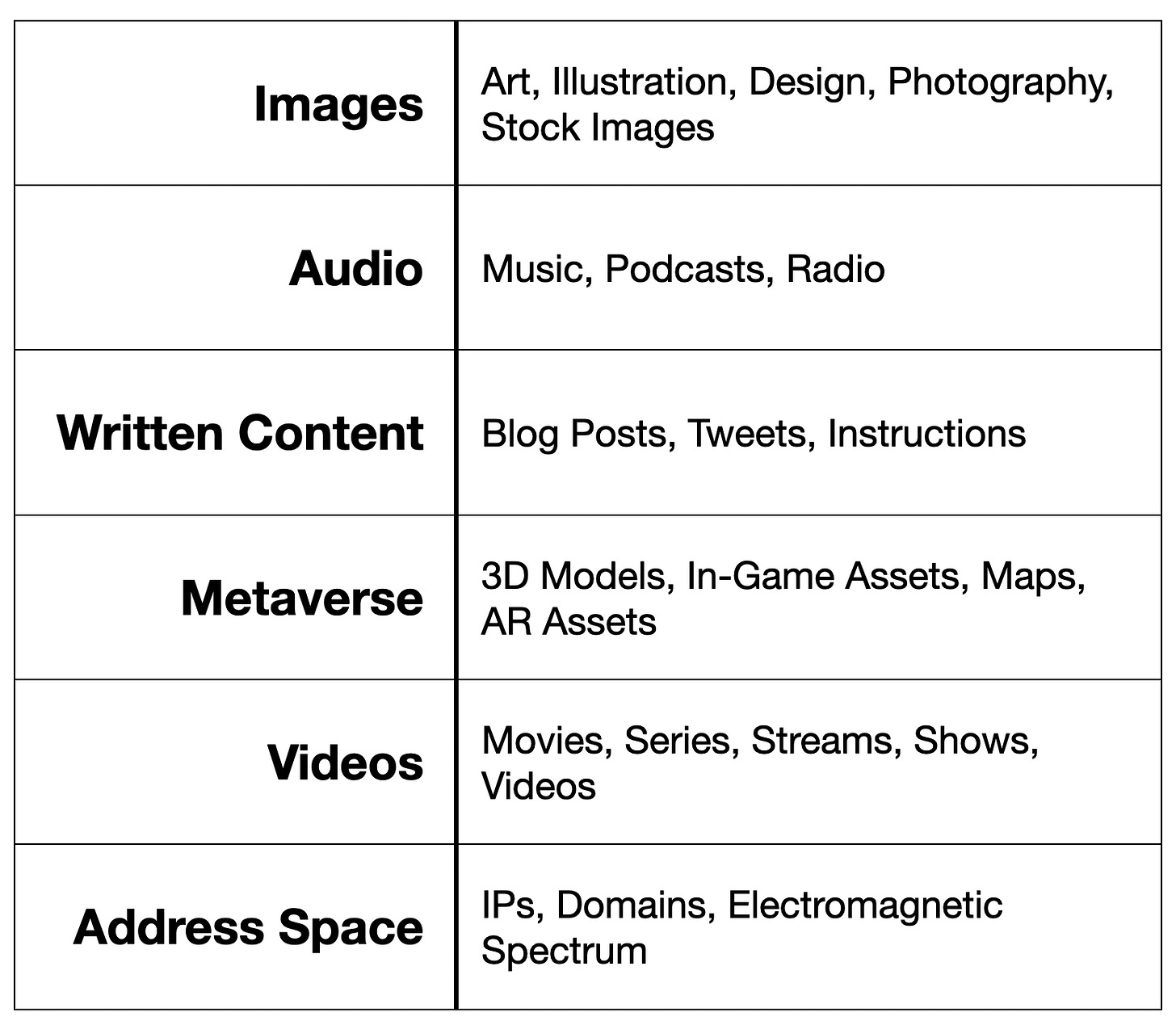

NFTs [1] are not just cat pictures that people trade on blockchains. Today digital art [2], collectibles [3], and in-game assets [4] are the most visible use cases for these nifty non-fungibles. But the market holds an inconspicuous secret: there is a staggering diversity of online digital content that can be placed on a blockchain in the form of NFTs.

Amazon, Netflix, and Hulu host over 23,000 pieces of on-demand video content. Disney+ and HBO Max have added nearly 10,000 more.

AR and VR creators are busy populating the Metaverse with 3D models. Marketplaces like TurboSquid are offering 60,000 3D models today [5] and are poised for growth.

In music, the world releases about 100,000 albums every year, [6] each with multiple tracks that can generate millions of plays. Recording artists are moving toward self-publication models [7] on services like SoundCloud and Audius [8] and toward self-distribution models like Spotify.

Shutterstock is home to over 330 million stock photographs which can be licensed and collect royalties. [9]

Over a billion domain names are registered each year, with 400m registered in the first quarter of 2017. [10]

We upload nearly 1.8 billion images per day [11] to the Internet, or a stunning 657 billion images per year.

In social media, we generate around 200 billion tweets per year [12], some of which accrued tens of millions of views and become iconic pieces of history or popular culture. [13] There are over 600 million blogs on the internet today.

This list is just scratching the surface of the broad spectrum of digital content. But we shouldn’t think of NFTs as tokenized digital content itself. A core insight is that NFTs are much better understood as encapsulating intellectual property rights to the assets they describe.[14]

To fully appreciate this view, consider that we seldom own anything on the internet today: we license ebooks from Amazon, we rent music plays from Apple Music, and we make payments to borrow domains from a registrar for a little while. Even when we create our own content, the rights to it are often owned by the content platform, distributor, or label. (In one case of recording artists and music labels, Taylor Swift wasn’t allowed to perform her own music [15] after having signed over rights.)

Most importantly, if we cannot truly own digital content, or easily license it, we will almost surely never resell it.

Blockchains and NFTs will change this state of affairs dramatically. First, they will digitize the rights to digital content in the form of blockchain assets. Second, they will allow for the assets to be placed on secondary markets. Thus, we can view NFTs as liquid intellectual property [18] for all forms of digital content, a marketplace which is measured in trillions of units that is about to be tokenized.

Tokenizing IP assumes, of course, that the creator assigns over actual intellectual property rights, enforced by law or smart contract, as part of the issuance process. This comes with some technical problems to solve, like choosing legal jurisdictions in which the rights would be enforced and connecting legal agreements to the minting process. Luckily, there is some precedent for these structures [16] and Aragon may become one option for a global, digital jurisdiction in the near future. [17]

But why should we want to own digital content when we already have it?

NFTs as a financial asset class

If NFTs are liquid IP, then holders will eventually own the property’s cash flows. This fact makes non-fungible tokens a financial asset class.

In the future, purchasing an NFT will entitle the owner to certain rights related to its content: the right to own and keep; the right to sell, license, and lend; as well as the right to royalties, the right to confer reuse (i.e. “movie rights”), and so on. That’s why taking a photograph of the Mona Lisa is not the same as actually owning Leonardo da Vinci’s masterpiece. You will not be able to charge 10.2 million yearly Louvre visitors an admission fee to see the print. [19] A similar principle applies to digital objects and their future cash flows.

As intellectual property rights inevitably move onto the blockchain as NFTs, trillions of units of digital content will move onto secondary markets. This will unlock tremendous illiquid value and become the biggest asset class in blockchain. Tokenization creates new ways of working with IP that were previously unavailable or too expensive to set up. For example, blockchain technology will automate IP provenance, use tracking, and rights management. Using existing standards and smart contracts, NFTs can be fractionalized, co-owned, and governed by multiple users or communities. Fractionalized tokens can be traded, crowdfunded, and incorporated into other financialization schemes to manage risk or unlock further value. (Projects like OpenLaw are venturing into new royalty technology and artist royalties are a popular topic in the #cryptoart scene. [20])

While tokenization will impact the liquidity of classic IP, digital-native use cases will arise as we look toward the future. Imagine owning the royalties to a Taylor Swift’s new album Folklore, or trading an index of your favorite digital artists like Frenetik Void [21] or Murat Pak. [22] Imagine selling a digital 3D model you built or licensing a stock photograph you shot directly from your phone into a global marketplace. More exotically, imagine supporting your favorite blogger or influencer by purchasing and owning their blog post or Insta story.

While the Metaverse seems like a distant digital dream, its digital assets are already here and new kinds of investors are taking notice. Andrew Steinwold’s Sfermion is a Metaverse-native firm that invests in “esoteric digital assets” [23], that is, NFTs of virtual worlds, digital art, and related assets. I suspect these assets won’t be esoteric for long. Companies like Fortnite are already measuring revenue streams in billions based on in-game digital objects, while Dapper Labs’ NBA Top shot just brought digital collectibles to the sports industry.

NFTs are about to become a new, voluminous financial asset class. To capture its value we need venues for selling, auctioning, and trading these new assets.

Rarible, the first decentralized and community-owned marketplace for the NFT asset class

Rarible is the first NFT marketplace in the blockchain space to launch a governance token. The token, called $RARI, can be obtained in exchange for marketplace participation and has found its initial liquidity on decentralized venues at Balancer and Uniswap. If you’ve ever transacted on Rarible or made an NFT purchase or sale on-chain, there is a good chance your address is eligible for the $RARI airdrop. [24] [25] [26]

The team at Rarible, founded by Alex Salnikov and Alexei Falin, is based in Moscow, Russia but engages the blockchain space globally and is open for business to anyone in the world who has a smartphone. [27] The Rarible team has continued to raise the bar on user experiences for both cryptonatives and mainstream users.

Today, Rarible comes with state-of-the-art features and experience for NFT creation: ERC-721 and ERC-1155 standards support, multi-edition mining, custom on-chain collections, and creator verification and moderation. On the demand side, top notch tools are in the works in the areas of discovery, engagement, and displaying works. Users new to blockchain should find friendly user experiences with Magic and Zerion integration, as well as upcoming credit card support. And, of course, Rarible’s moderated incentive program distributes $RARI rewards for users who transact on the platform.

But the real innovation of Rarible is that it is on a path of gradual decentralization toward community ownership, making it a highly competitive venue to attract participants. Rarible is currently in the process of implementing full decentralized governance, just like many DeFi projects are launching today. As a result, the platform’s core features, economics, and smart contracts will eventually be totally in the hands of the Rarible community through $RARI ownership.

Over time, we think cryptonative monetization and the core value propositions of crypto networks [28] implemented by Rarible will make it highly competitive with other digital marketplaces and Rarible will be a premiere venue for NFT liquidity. The community-building properties of digital assets have been discussed previously [29] and Rarible has already seen an immense response in platform metrics following the launch of the digital asset. Using $RARI, Rarible will be able to shore up a strong, loyal community that maintains an active 2-sided marketplace.

At CoinFund, we’re excited to support the Rarible team’s highly cryptonative approach as the asset class of non-fungibles continues to develop. Mint or browse some NFTs on Rarible today.

Special thanks to the Rarible team, Jesse Walden, Roneil Rumberg, Nick Cowen, Alex Felix, Oleg Golubov, Sasha Hudzilin, Pri Desai, Aaron Wright, Roxy Sklavos, Michael Bosworth, Yashar Dehaghani, Ashley Tyson, Austin Barack, Sandro Gorduladze, Andrew Steinwold, Sam Brukhman, and others for giving great feedback on this post.

References

[1] NFTs https://en.wikipedia.org/wiki/Non-fungible_token

[2] Digital art https://app.rarible.com/frenetik/created

[3] Collectibles https://www.cryptokitties.co/

[4] In-game assets https://www.cryptovoxels.com/wearables

[5] TurboSquid marketplace https://blog.turbosquid.com/2016/03/10/real-time-portal-60k-3d-assets/

[6] Annual album volume https://www.quora.com/How-many-albums-and-singles-are-released-a-year-worldwide

[7] Self-publication on SoundCloud https://www.billboard.com/articles/business/digital-and-mobile/8551334/soundcloud-mobile-upload-artists-recordings

[8] Audius https://audius.co/

[9] ShutterStock https://shutterstock.com

[10] Domain name registrations https://www.quora.com/How-many-domains-name-are-registered

[11] Daily image uploads https://www.dailydot.com/debug/mary-meeker-photo-report/

[12] Tweets per year https://www.dsayce.com/social-media/tweets-day

[13] “Funding secured”

[14] NFTs as intellectual property rights

[15] Taylor Swift music rights https://www.cnn.com/2019/11/14/entertainment/taylor-swift-scooter-braun/index.html

[16] The LAO https://medium.com/openlawofficial/the-lao-a-for-profit-limited-liability-autonomous-organization-9eae89c9669c

[17] A global, digital jurisdiction https://aragon.org/blog/aragon-network-on-a-path-towards-a-digital-jurisdiction-752ccf4b9d5c

[18] Mona Lisa at the Louvre https://www.nytimes.com/2019/08/12/arts/design/mona-lisa-louvre.html

[19] Liquid intellectual property

[20] “Modernizing art with blockchains” https://medium.com/@OpenLawOfficial/modernizing-art-with-blockchains-6cba4694833d

[21] Frenetik Void https://twitter.com/frenetikvoid?lang=en

[22] Murat Pak https://twitter.com/muratpak

[23] Andrew Steinwold’s Sfermion https://medium.com/@andrew_34383/sfermion-a-metaverse-native-investment-firm-6aace1733e61

[24] Rarible launched $RARI https://www.coindesk.com/yield-farming-expands-from-finance-to-digital-collectibles-rarible-nfts

[25a] Balancer pool for $RARI https://balancer.exchange/#/swap/0xfca59cd816ab1ead66534d82bc21e7515ce441cf

[25b] Uniswap pool for $RARI https://app.uniswap.org/#/swap/0xfca59cd816ab1ead66534d82bc21e7515ce441cf

[26] $RARI airdrop https://app.rarible.com/rari

[27] Russian teams in blockchain

[28] “The 9 core value propositions of crypto networks” https://blog.coinfund.io/what-we-look-for-the-9-core-value-propositions-of-crypto-networks-88b04d09d873

[29] “Community ownership as a blockchain adoption model” https://blog.coinfund.io/community-ownership-as-a-blockchain-adoption-model-71a87f167de2

Disclaimer: The content provided on this site is for informational and discussion purposes only and should not be relied upon in connection with a particular investment decision or be construed as an offer, recommendation or solicitation regarding any investment. The author is not endorsing any company, project, or token discussed in this article. All information is presented here “as is,” without warranty of any kind, whether express or implied, and any forward-looking statements may turn out to be wrong. CoinFund Management LLC and its affiliates may have long or short positions in the tokens or projects discussed in this article.